“Someday financial markets will decline...rising stock/bond markets will no longer be government policy. QE will end and money won’t be free. Corporate failure will be permitted. The economy will turn. Someday, somewhere, somehow, investors will lose money and once again come to favor capital preservation over speculation. Someday, interest rates will be higher, bond prices lower, and the prospective return from owning fixed-income instruments will again be commensurate with risk.” Seth Klarman

Tuesday, March 22, 2016

Why wait until it's been 20-30 years and it collapses...worthless. Is it time for your life insurance audit? From a foundation of ignorance...there is a wave coming...is your life insurance even competent?

"Is there a life insurance bubble that is about to go bust?

Life insurance buyers have two main options: term insurance that only pays if you die, or an insurance policy that has a savings or investment feature. That is often called universal or whole life. It's those types of policies, universal and whole life that we are talking about.

Transamerca Corporation no longer has its headquarters in the iconic Transamerca pyramid in downtown San Francisco. The signature building is still a part of the companies logo along with the words, "Transform tomorrow."

Mary and Gordon Feller bought Transamerica policies back in the 1980s and say the company has indeed transformed their tomorrow.

"The projections we were given were based on eight percent interest rate and there was never a time where the policies earned eight percent," Mary Feller said. "Now, suddenly the cost of the insurance has skyrocketed. So when we put in $250 or $500 or $700, or whatever we put in on that quarterly basis, that money is eaten up."

"Well, here we are 25 years later. The baby boomer generation is ready to retire. Now the companies say, 'Whoa, we've got to make good on our promise? No, we're walking away,'" said the Feller's attorney Harvey Rosenfield...."

LINK

Monday, March 7, 2016

"Is This Entire Rally Just One Big TRAP?"

"Few analysts realize that the sharpest, most aggressive rallies occur during bear markets. The reason for this is that during bear markets, investors tend to go short (borrow shares to bet on a collapse).

So when the market rallies even a little bit, it often will go absolutely vertical as these individuals panic and cover their shorts (which increases the buying power of the move).

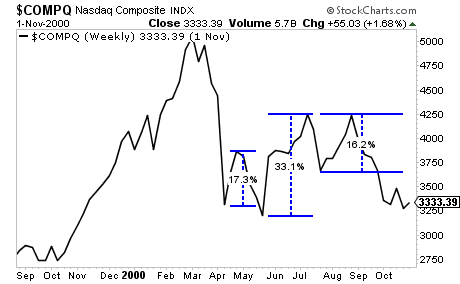

Consider the Tech Bubble. When it burst, we had THREE monster rallies of 17%, 33% and 16% in just SIX months time!

Anyone who bought into these moves for the long-term ended up get crushed as the market soon rolled over and worked its way down.

The below chart gives some perspective on just how much further stocks would fall relative to these bull traps!

Smart investors, however, used those rallies to prep for the next round of the drop. They didn’t get suckered into believing that it was the beginning of the next bull market...."

Graham Summers, Phoenix Capital Research

Tuesday, March 1, 2016

Subscribe to:

Posts (Atom)