"The situation in Greece has very little to do with politics or economics. Instead it is entirely focused on just one thing.

That issue is collateral.

What is collateral?

Collateral is an underlying asset that is pledged when a party enters into a financial arrangement. It is essentially a promise that should things go awry, you have some “thing” that is of value, which the other party can get access to in order to compensate them for their losses.

For large European banks, EU nation soveregin debt (such as Greece) is the collateral backstopping hundreds of trillions of Euros worth of derivative trades.

This story has been completely ignored in the media. But if you read between the lines, you will begin to understand what really happened during the Greek bailouts.

Remember:

1) Before the second Greek bailout, the ECB swapped out all of its Greek sovereign bonds for new bonds that would not take a haircut.

2) Some 80% of the bailout money went to EU banks that were Greek bondholders, not the Greek economy.

Regarding #1, going into the second Greek bailout, the ECB had been allowing European nations and banks to dump sovereign bonds onto its balance sheet in exchange for cash. This occurred via two schemes called LTRO 1 and LTRO 2 which happened in December 2011 and February 2012 respectively. Collectively, these moves resulted in EU financial entities and nations dumping over €1 trillion in sovereign bonds onto the ECB’s balance sheet.

Quite a bit of this was Greek debt as everyone in Europe knew that Greece was totally bankrupt.

So, when the ECB swapped out its Greek bonds for new bonds that would not take a haircut during the second Greek bailout, the ECB was making sure that the Greek bonds on its balance sheet remained untouchable and as a result could still stand as high grade collateral for the banks that had lent them to the ECB.

So the ECB effectively allowed those banks that had dumped Greek sovereign bonds onto its balance sheet to avoid taking a loss… and not have to put up new collateral on their trade portfolios.

Which brings us to the other issue surrounding the second Greek bailout: the fact that 80% of the money went to EU banks that were Greek bondholders instead of the Greek economy.

Here again, the issue was about giving money to the banks that were using Greek bonds as collateral, to insure that they had enough capital on hand.

Piecing this together, it’s clear that the Greek situation actually had nothing to do with helping Greece. Forget about Greece’s debt issues, or protests, or even the political decisions… the real story was that the bailouts were all about insuring that the EU banks that were using Greek bonds as collateral were kept whole by any means possible.

So here we are today and Greece is back in the headlines. Once again the country is out of money and the ECB and IMF are trying to punish it without hurting the larger EU banks.

Why are they making such a big deal about Greece… a country whose GDP is just 2% of the EU?

Because whatever happens in Greece will be used as a template for much larger problems AKA Spain and Italy.

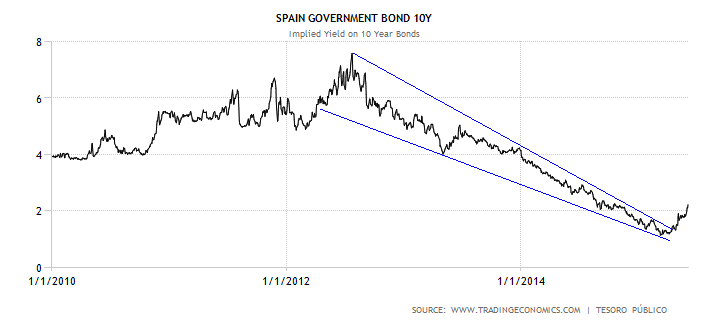

Spain and Italy, by comparison, have €1.78 trillion and €1.87 trillion in external debt respectively.

That is a heck of a lot of collateral that would be in BIG trouble in the event of a bond crash for either country.

And both countries have bond yields that are spiking...

Here's Italy:

Smart investors should take note of this now. It is a MAJOR red flag to be watched closely."

Graham Summers

Phoenix Capital Research

No comments:

Post a Comment